Facebook sees mixed Q2 earnings with slowest-ever growth, stock tanks

Facebook sees mixed Q2 earnings with slowest-ever growth, stock tanks

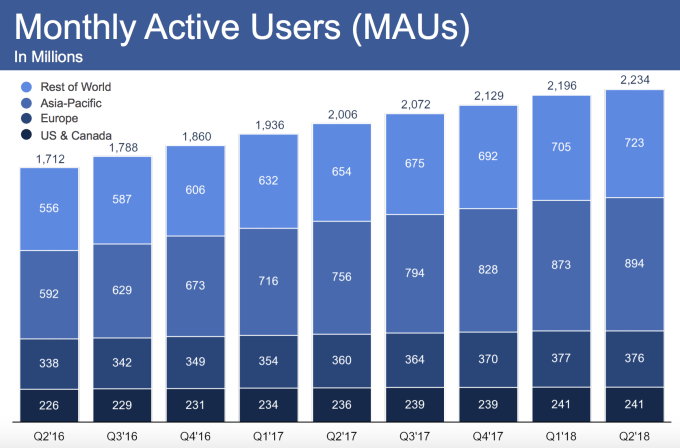

Facebook succumbed to the public backlash over its handling of fake news, privacy, and digital wellbeing to miss some of Wall Street’s estimates, showing mixed results in its Q2 2018 earnings. GDPR, Mark Zuckerberg’s testimony before congress, and more scandals appear to have contributed to Facebook’s weak user growth, with it reaching 2.23 billion monthly users, up 1.54 percent, much slower than Q1’s 3.14 percent around where its growth rate has hovered for years. Facebook earned $13.23 billion in revenue, missing Thomson Reuters consensus estimates of $13.36 billion, but beat with $1.74 EPS compared to an estimated $1.72 EPS.

Daily active users reached 1.47 billion, up an especially low 1.44 percent percent compared to Q1’s 3.42 percent. Facebook’s daily and monthly user counts were up 11 percent year-over-year, confirming that the momentum of its business is still overpowering its PR problems when you zoom out. And its DAU to MAU ratio held firm at 66 pecent, indicating that users are still visiting the site often. But the question for today’s earnings call will be whether time spent on the site has decreased significantly, dragging down revenue with it.

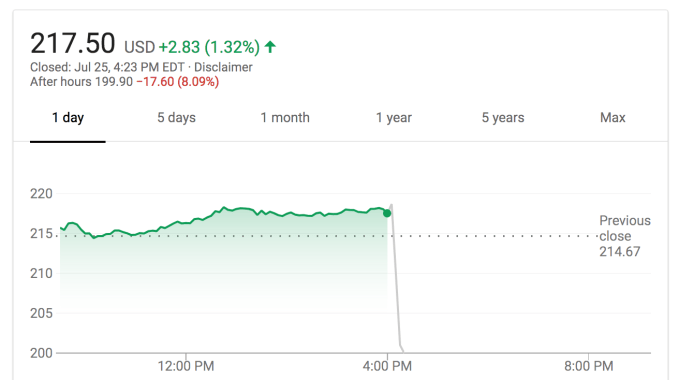

The stock market frowned heavily on the slow growth rates, pushing Facebook’s share price down over 7 percent in after-hours trading to around $200 per share. That’s despite it earning $5.106 billion in profit and revenue being up 42 percent year-over-year.

One trouble spot for Facebook was that it got stuck at 241 million monthly US & Canada users, the same count as last quarter. And in Europe, Facebook lost 1 million users, sinking to 376 million monthlies. That could be sign that GDPR requirements and the annoying terms of service changes it had to get users to agree to deterred some from browsing.

Facebook still managed to boost its average revenue per user in all markets, growing from $23.59 to $25.91 in the US & Canada, showing its targeting continues to improve and competition for ads is strong. But the fact that it’s stopped growing at home could way heavily on its share price. Facebook will have to continue to invent more ways to squeeze dollars out of its existing users.

The quarter saw Facebook clamp down on APIs for developers in hopes of preventing another Cambridge Analytica style disaster. Its CEO faced tough days of questioning from congress over the privacy problem, alleged bias against conservatives, and its failure to protect the 2016 presidential election. Facebook tried to redirect attention away from its problems during its F8 conference that saw it announce plans for a dating feature.

But all the problems may be taking a toll on user engagement, leading to the revenue miss. Weak daily and monthly user growth should be a big concern, and will put even more pressure on Instagram to prop up the corporation.

from Mobile – TechCrunch https://ift.tt/2LMk1GV

via Blogger https://ift.tt/2JRKJwc

July 26, 2018 at 01:48AM

via Blogger https://ift.tt/2LTm8Jm

July 26, 2018 at 02:33AM

via Blogger https://ift.tt/2Lqm1bI

July 26, 2018 at 05:33AM

0 Comments